Analyzing your business’s success is crucial when trying to survive and learn how to grow sustainably. You may know that looking at your financial reports is essential for analyzing your company’s growth, but you may not know exactly what to look at. Although you can use tools such as your chart of accounts, you may need to dig a little deeper to find out why your business is doing well or struggling.

Having a clear picture of your business’s profitability will allow you to discover areas for improvement and where your strengths lie. Seeing positive numbers is a highlight and knowing why your business is profitable can help you make better investment decisions and understand where to take your business next.

So, how can you calculate your business’s profitability? Follow these formulas to measure your profit margin and see how accounting tools like this can help your business thrive.

Are you interested in accounting services that could transform your business? Contact Financial Optics today to learn how financial insight can take your business to the next level!

What Is Profitability?

Profit and profitability are similar things, but there are some stark contrasts. Profit is an absolute number determined by income and revenue beyond costs or expenses a company incurs. This is calculated by taking the total revenue minus total expenses that appear on an income statement.

A business’s profitability is relative to the profit of your business. It’s a metric used to determine the scope of your company’s profit about the size of the business. In other words, a business can produce a return on an investment based on its resources compared to other investments. Although businesses can have a profit, it may not always mean they’re profitable.

Why Is It Important to Measure Profitability?

Measuring the profitability of your own business is essential for understanding if your business is making enough money and if your investments are paying off. Analyzing your company’s cash flow allows you to understand better which products or services are responsible for the success of your business.

When you know which factors contribute to the flow of revenue, you can make better decisions on which investments to make. You can see which products or services your customers like and create lines of products that are similar to that or offer services that match a customer’s needs. Offering this level of dedication to your customers allows them to feel like you care and also allows you to bump up your revenue.

Understanding your business’s profitability is crucial for understanding how you’re spending your money. If your business is sinking because you’ve taken on too much debt or have an excess amount of expenses, you are lowering your profit margin.

Understanding Your Profit Margin

Your profit margin is the measure of your business’s profitability. It’s expressed as a percentage and measures how much of every dollar in sales or services your company keeps from its earnings. This reflects your net income when it’s divided by the new sales or revenue. In other words, a great way to see how much money your business is making.

When a company is profitable, it shows that it can efficiently utilize resources and its capital. If you have a profit but are unprofitable, you are investing in projects that could lead to sunk costs (money that has already been spent and cannot be recovered).

If you calculate your profitability, then you can explore your profitability index to determine if a project is worth perusing to reduce the occurrence of project failures.

When you can analyze and understand the profit margin of your business, you can determine how much money you are making and see the representation of the overall financial health of your business. If you’re unsure how to turn your profitability around, you can consult your outsourced small business accountant or CFO to understand what actions can be made to change your profit margin.

Are you interested in accounting or CFO services that will grow your business? Contact Financial Optics today to learn how we can help you!

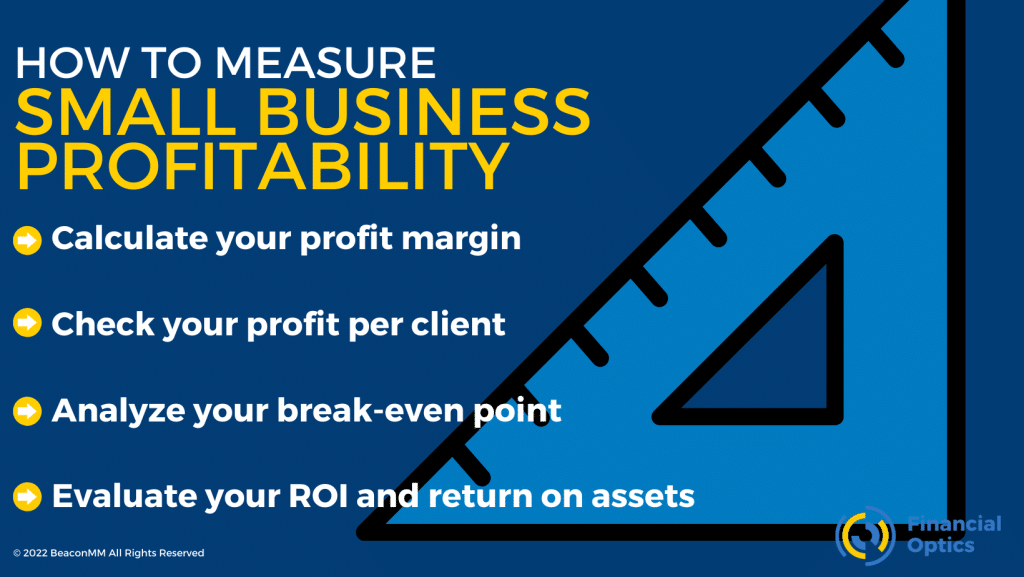

How to Measure Small Business Profitability

There are several ways that you can measure your small business profitability. They allow you to see different aspects of your business’s success and get concrete numbers for what you’re doing well. The following are four ways to measure your profitability and what this can tell you about your business.

1. Calculate Your Profit Margin

Calculating your profit margin ratios is one of the best ways to determine if your business is profitable. There are three things to calculate from your income statement, including:

- Net Sales – Cost of Goods Sold = Gross Profit

- Gross Profit – (Operating Costs, including Selling and Administrative Expenses) = Operating Profit

- (Operating Profit + Any Other Income) – Additional Expenses – Taxes = Net Profit

These three figures will give you a dollar perspective on your profit. You can further analyze them by turning them into ratios that will help you measure your business’s efficiency. If you’re unsure how to do this, you can consult your accountant or CFO to get help calculating the numbers and analyzing their impact on your company.

2. Check Your Profit Per Client

One of the ways that you can reevaluate how your business is doing is by checking the profitability of your clients. As time goes on, you may have clients from when you first started doing business that are being charged for your original prices. Although you don’t want to hurt that relationship, there could be room to raise the price for the extensive services you’ve provided for them.

You can calculate your profit per client by using the following formulas:

- Total Project Fees – Project Expenses = Gross Profit per Project

- Gross Profit per Project ÷ Hours Spent on Project = Hourly Wage

3. Analyze Your Break-Even Point

When your business breaks even, your revenue and expenses are the same. It doesn’t mean that your business is losing money, but it does mean that you’re not making enough for a profit.

One way to calculate your break-even point includes:

- Fixed Expenses + Variable Expenses = Break-Even Point

If you want to understand your break-even point by measuring it against how many units you’ve sold, you can calculate it with the following formula:

- Fixed Expenses ÷ (Units Sales Price – Unit Variable Expenses) = Break-Even Point for Units Sold

4. Evaluate Your ROI and Return on Assets

Your return on assets (ROA) shows you your total revenue compared to the total amount of assets used. You can compare this number quarterly to see if your ROA rises to reflect an efficient operation.

A ROA formula includes:

- (Net Income Before Taxes ÷ Total Assets) X 100 = ROA

If you want to see your ROI that represents your company’s earnings compared to your investments, then calculate using the following formula:

- Net Profit Before Tax ÷ Net Worth = ROI

How Can an Accountant Help With Profitability?

Utilizing your accountant to understand your profitability can be one of your best business decisions. Since they are constantly working with your accounts, they can see the change over time and any places of concern. They’ll be able to utilize the financial reports to see which areas of your business need improvement and where you’re excelling to make better investments. They can also help you calculate your profitability and break it down in a way that is understandable to you.

Financial Optics offers fantastic small business accounting with three tiers of services: bookkeeping, accounting, and virtual CFO services. For a small business, outsourcing your accounting can be a great way to get the top quality accounting services while paying less than you would for a full-time accountant. When you partner with Financial Optics, you can gain over 30 years of expertise on top of amazing accounting services that will take your business to the next level.

Are you ready to transform your business and boost your profitability? Schedule a free consultation with Financial Optics today to learn we can help your business thrive!