Whether you’re doing the accounting and bookkeeping yourself or outsourcing it, you should know accounting terms that could help you make decisions. The financial status of your small business is crucial for sustaining the production you’re doing and possibly investing in new ventures to grow your company.

As a business owner doing the accounting yourself, you’ll need to learn accounting to ensure that you’re tracking everything right. It can ensure that you don’t run into trouble with your company going bankrupt or mishandling taxes.

If you’re outsourcing your accounting, it’s good to know accounting terms to make it easier when looking over your statements. It’ll also help you and your financial advisor talk about growing your business sustainably.

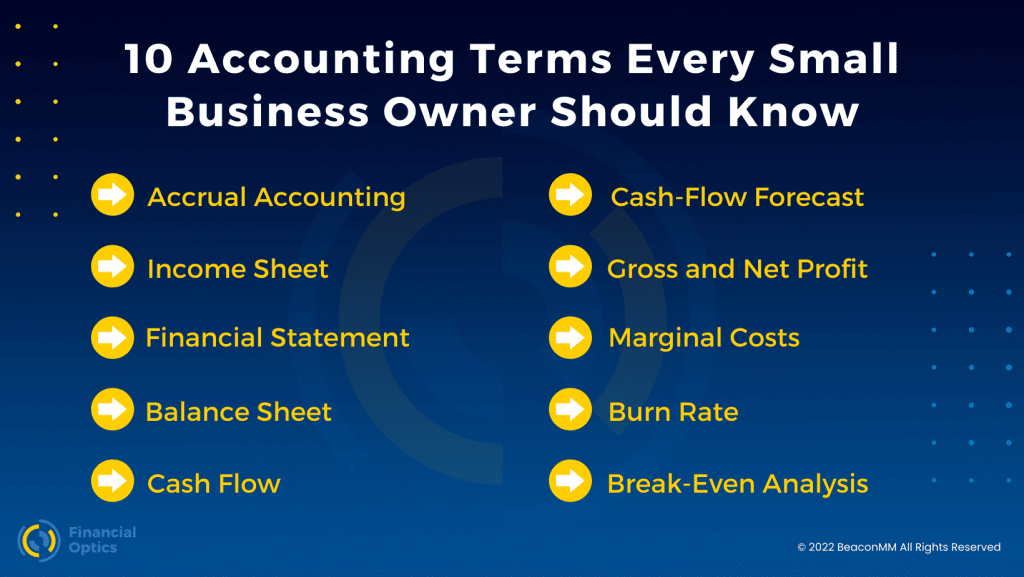

Learning the following terms can help you make the right decisions for your business by understanding the financial status of your company. Here are ten accounting terms you should know for your small business.

Are you interested in bookkeeping or accounting services for your small business? Contact Financial Optics today to get help!

1. Accrual Basis Accounting

Accrual Accounting is the method of tracking revenues and expenses based on when they occur rather than when they are paid (cash basis accounting). For example, if you finish your work in January, invoice the client in February, and are not paid until March, it would still be reported as revenue for January. This method of accounting is more reliable for analyzing profitability and is a long-term proof of value.

2. Income Statement

An income statement details your company’s net profit for a particular period based on all revenues minus all expenses. This can be used as a benchmark for performance and understanding your profitability. It can help you decide on potential investments you’d like to make or show signs of needing to increase profitability. Much like other financial statements, you can use this to explore what needs to change in your business model to become more profitable. The income statement is sometimes referred to as the Profit & Loss Statement.

3. Financial Statement

A financial statement is a collection of all reports documenting every financial transaction your company has made. This includes your balance sheet, profit and loss (P&L) or income statement, and cash-flow statements. You can use your financial statement to understand how your business is doing and see where you can take your company next. Getting help from a virtual CFO can help you identify the right time to invest in growing your company and how you can sustainably do so.

4. Balance Sheet

Your balance sheet is crucial for ensuring that everything was documented correctly. This financial history showcases three categories consisting of:

- Assets: Includes things like available cash, property, equipment, and vehicles

- Liabilities: Includes any debts, loans, or purchases on credit

- Shareholder’s Equity: Includes the net book value of any assets that the owners can claim. The formula is Assets minus Liabilities equals Equity.

The balance sheet provides you with a great way to help you see the value of your business alongside any debts that you currently have. Looking at this can help you stay on top of paying debts and ensure that you’re lowering your debts over time.

5. Cash Flow

Cash flow is a glimpse of the timing and amount of cash coming in and out of your business. It calculates all money collected and spent on operations, investments, and financing. Looking at your cash flow regularly can help you analyze what parts of your business that might be slowing down your cash flow, or worse needlessly burning cash flow. It will help you understand what moves can be made to free up cash flow.

6. Cash-Flow Forecast

To help you understand which investments are right for your small business, you can meet with your financial advisor to go over your cash-flow forecast. These statements are a way to analyze your projected income and expenses to see the potential amount of money that will move through your business. Building these forecasts can help you create investment scenarios based on new projects or investments to determine if they’ll help pay off debts or lead to profitability. You’ll sleep better at night using these reports to understand how much cash you business is going to need, when you will need it, and where it will come from.

Are you interested in getting financial insight into your company to make better investments? Contact Financial Optics today to learn how your business can grow!

7. Gross and Net Profit

Gross profit is the profit you make after subtracting your direct cost of producing your product or service. Then your net profit is the amount of income your company has left after paying all operating expenses. Understanding the difference can help you price your products or services correctly to guarantee that your business is truly profitable.

8. Marginal Costs

Marginal cost is the difference in profit you make by selling more than one unit of goods. It can be found by dividing the total cost of production by the number of products you want to make and comparing the results. Analyzing your marginal costs can help you evaluate a more cost-efficient way to produce goods while increasing the number of units produced. Keep in mind that although you may find a way to produce more and save money at your current status, you may have to hire more people or invest in new equipment to keep up with the growing demand.

9. Burn Rate

The burn rate is how long you can cover your operating costs using your cash on hand without generating positive cash flow from operations. You should measure the burn rate to ensure that you won’t be caught in a situation where you have to find funding at the last minute. If you can analyze how much money you currently have, how much it costs to produce or provide a service, and how long you can sustain it, you’ll clearly understand when your business needs to become profitable.

10. Break-Even Analysis

The break-even analysis is when the income matches the expenses of your business or specific product or services. Understanding this analysis can help you see the burn rate and learn how to effectively make pricing decisions on your products that will impact your ability to achieve profitability.

How Can Financial Optics Help Your Small Business?

Financial Optics is a small business accounting company dedicated to ensuring that your bookkeeping and accounting are done correctly. We offer different levels of accounting services that will allow you to gain financial insight into your business.

If you’re running your business, we know that accounting is another task that can make you feel overwhelmed. When you choose to outsource your accounting, you can rest assured that everything is done correctly, and you can focus on what you’re truly passionate about.

We also offer virtual CFO and business advising for owners ready to take their business to the next step. Our advisors can help you see which investments will help grow your business and see if you’re financially ready to take the next step for your small business.

With over 30 years of experience, we’re here to help you grow your business. We can monitor your finances daily and ensure that everything is correct. You’ll even still be able to maintain full access to your reports and numbers so you can check them at any time.

If you’re ready to take your business to the next level, but you’re not sure how, Financial Optics is ready to help you.

Are you interested in how we can help your small business? Schedule a consultation with Financial Optics today!